The tablet brought the promise of a screen-based computing device that would be much easier to carry around and handle than a laptop computer while making relatively small sacrifice in screen size and computing capabilities (e.g., the kinds of software it would be able to operate efficiently). Still, the tablet should provide better display (e.g., a 10” screen easier to read from and work with) and better functional capabilities than a smartphone. Yet, less than ten years since the tablet was introduced and the global sales of tablets already seem to be falling back, according to International Data Corporation (IDC) . Pressed in a position between personal computers (desktops & laptops) and smartphones, the tablets appear to have a hard time to fulfill their mission.

The worldwide sales (shipments) of tablets grew quickly from 19 million units in 2010 and 76 million units in 2011 to a peak of 230 million units in 2014 [1] . In the following three years, however, the sales slid to 163.7m units in 2017. Sales in 2018 are estimated to amount to 150.3m units.

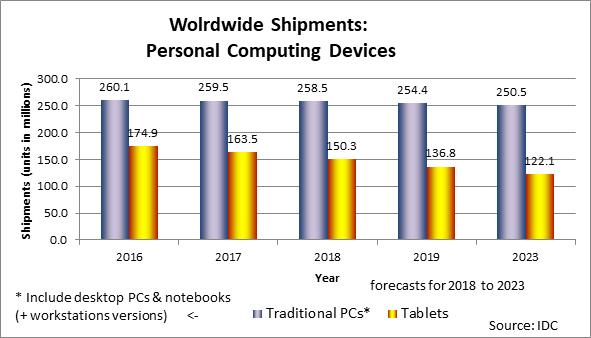

IDC recently published its forecasts for the global sales (shipments) of traditional personal computers (desktop PC and notebook/laptop) and tablets in 2019 and 2023 (March 2019, [2]): the sales of tablets are forecast to continue to fall to 136.8m units in 2019 and down to 122.1m units in 2023 — that is, slightly above 50% of its peak of 2014. Traditional personal computers actually hold up quite bravely with a slow decline over the past few years (260m to 258m units in 2016-2018), and are expected to decline further to 250.5m units by 2023.

It should be noted here that the sales of notebooks (laptops) are forecast even to recover somewhat until 2023 while the sales of desktop PCs will continue to drop. The rise in sales of notebook PCs is expected to come from the business or commercial market and not from the consumer market. The compound annual growth rate (CAGR) of desktop PCs is expected to be negative at -2.6% between 2019 and 2023 compared with +0.7% growth in sales of notebook portable PCs.

- Surges in purchases of personal computers are seasonal and occur especially in the fourth quarter of each calendar year, ahead of the Christian holidays — Christmas and New Year — being helped by retail promotions. IDC comments, however, that Q4 of 2018 was weaker than usual, showing the “lowest sequential growth for a holiday quarter since the fourth quarter of 2012” [3]. The total sales by shipments of traditional personal computers worldwide were 3.7% lower in Q4/2018 vis-à-vis Q4/2017 (i.e., not helped enough by sales to consumers).

Furthermore interesting, the continued decline foreseen in the sales of tablets concerns primarily the slate tablets — these are the more familiar standalone tablet devices. More hope for the sales of tablets may come from a rise in demand for detachable tablets — this is a screen that can be separated from the keyboard platform of a laptop and function independently as a tablet. Nevertheless, detachable tablets account at this time for just about 20% of all tablets. Nonetheless, laptops with a detachable screen-tablet are relatively expensive. The shipments of detachable tablets are forecast to grow at CAGR of 4.6% between 2019 and 2023 (up to 26.5m units) whereas the shipments of slate tablets might drop at CAGR of -4.4% (from 114.7m units in 2019 down to 95.6m in 2023).

In order for the tablet to succeed as an alternative computing device it should enable enough uses similar to a personal computer that will be practical and convenient to perform on the tablet (e.g., in travel, away from home/office) more than either with a laptop computer or a smartphone. Have tablets stood this test? How conveniently and efficiently can tablets be used, for instance, for preparing documents or presentations, analysing data, or editing photos? Tablets are more practical for displaying such content rather than producing it. A tablet has to be good for more than browsing the Internet, conversing in social media networks, checking the e-mailbox and answering, or using personal apps (including games) — for these purposes most users are comfortable enough using their smartphones, especially when acting as consumers.

Users should perceive the tablet as helpful in doing a range of jobs broad enough to justify keeping a third device in addition to a traditional personal computer and a smartphone. It may need to be conducive in performing particularly critical jobs for the user; it has to show clear advantages for completing those tasks or jobs in certain circumstances and conditions than with the other devices.

Tablets may see a brighter future emerging from two sources: (1) Users will be persuaded by the benefits of using a hybrid laptop with a detachable screen as a dual solution — the laptop can be used for certain jobs or tasks it is more capable for when the screen is attached to it, and the detached screen can be applied as a tablet for other jobs it is suitable and helpful in performing (some and even many tasks may be executed in both modes); (2) Users will be convinced that larger-screen smartphones — 7”+, folded phones or ‘phablets’ — are not really convenient enough to handle and are too challenging to apply for performing some of their advanced jobs, hence this type of phone is not a substitute for a solid (‘slate’) tablet. The game is far from over, where users, as consumers or professionals, can be expected to continue and toggle between devices until each one finds the most appropriate and helpful combination of devices for him or her.

Notes:

[1] IDC’s press releases with recent figures based on their ‘Worldwide Quarterly Personal Computing Device Tracker’ and also the ‘Quarterly Tablet Tracker’ (available for 2017-2018) + a chart “Shipment Forecast of Laptops, Desktop PCs and Tablets Worldwide from 2010 to 2023”, Source: Statista based on IDC’s data, including historical figures no longer available at IDC website.

[2] “Personal Computing Device Shipments Forecast to Continue Their Slow Decline with a Five-Year Compound Annual Growth Rate of -1.2%, According to IDC”, Press Release, IDC, 7 March, 2019

[3] “Inventory and Processor Supply Issues Weigh Against PC Shipments, According to IDC”, Press Release, IDC, 10 January 2019

Additional Reading (Sources):

“PC Sales Are Growing for the First Time in Six Years: IDC and Gartner Agree”, Tom Warren, TheVerge.com, 13 July 2018

“How Device Usage Changed in 2018 and What It Means for 2019”, Viktoriya Trifonova (Trends), GlobalWebIndex, 20 November 2018

(This blog article shows changes in behaviour in using computer devices that, Trifonova says, are not reflected fully in figures on sales or shipments of the devices. The main ‘victim’ of these changes are the tablets — users found them less suitable and less necessary, while shifting more of their computer-based and online activities to smartphones. For uses that smartphones remain less convenient for, consumers continue to apply a desktop or laptop PC.)